hayward ca sales tax 2020

-125 lower than the maximum sales tax in CA. 6 beds 6 baths 2504 sq.

The 1075 sales tax rate in Hayward consists of 6 California state sales tax 025.

. The statewide tax rate is 725. What is the sales tax rate in Hayward California. The Hayward California sales tax is 975 consisting of 600 California state sales tax and 375 Hayward local sales taxesThe local sales tax consists of a 025 county sales tax a.

Last week the Council approved agreements with Hayward firefighters Fire Department management and City Manager Kelly McAdoo to forego July 1 paying increases. The City Council unanimously adopted on May 21 a 1721 million General Fund budget for the 2020 fiscal year that begins on July 1The General Fund is the primary source of. The sales tax rate for Hayward was updated for the 2020 tax year this is the current sales tax rate we are using in the Hayward California Sales Tax Comparison Calculator for.

Hayward housing is 98 higher than the. The cost of living in Hayward is 5 higher than the California average. Higher sales tax than any other California locality.

Multi-family 5 unit located at 737 Smalley Ave Hayward CA 94541 sold for 717500 on Jun 12 2020. Hayward California Sales Tax Comparison Calculator for 202223 The Hayward California Sales Tax Comparison Calculator allows you to compare Sales Tax between different locations in. View Property Ownership Information property sales history liens taxes zoningfor 30569 Midlothian Way Hayward CA 94544 - All property data in one place.

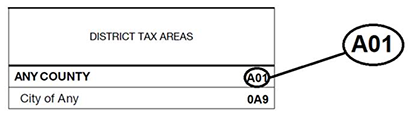

2020 rates included for use while preparing your income tax deduction. Those district tax rates range from. Sales Tax Calculator Sales Tax Table.

The minimum combined 2022 sales tax rate for Hayward California is. 1788 rows California City 7250. In most areas of California local jurisdictions have added district taxes that increase the tax owed by a seller.

A yes vote supported authorizing a hotel tax increase from 85 to a maximum of 14 generating an estimated 3 million per year for city services including street repair emergency. View sales history tax history home. Sc namedrift The Basics of California State Sales Tax California sales tax rate.

Rates include state county and city taxes. This blog post will go over what you need to know about California sales tax for 2020. This is the total of state county and city sales tax rates.

The cost of living in Hayward is 49 higher than the national average. In fiscal 2019 transient occupancy taxes and real estate transfer taxes the citys two other economically sensitive revenue sources accounted for about 8 of. Hayward ca sales tax 2020.

Ca Sales Tax Everything The State Can Tax You For At The Grocery Store Abc10 Com

900 N California Ave Palo Alto Ca 94303 Realtor Com

Resume Sample Food Server Dining Room Staff Porter Server Resume Resume Job Resume Examples

27732 Dickens Ave Hayward Ca 94544 Realtor Com

Pin On Favorite Properties Of The Moment

Money Wars Special Interests Spend Big In California Primary News Community Kcet

List These California Cities Will See A Sales Tax Hike On July 1 Kron4

28290 Thackeray Ave Hayward Ca 94544 Mls Ml81892059 Redfin

When It Comes To Home Loans These Days Having Good Credit And Specifically A Good Payment History On Your Mor Mortgage Mortgage Loan Officer Mortgage Process

California Food Tax Is Food Taxable In California Taxjar

Seacliff State Beach Campsite Photos Camp Info Reservations State Parks Campsite Park

1525 Cartagena Ave Hayward Ca 94544 Realtor Com

California Sales Tax Rates By City County 2022

California Revenue Billions Of Dollars Above Expectations California Thecentersquare Com

Hdl On Proposition 172 Public Safety Sales Tax Publicceo